XRP Price Prediction: Analyzing the Path to $5 Amid Institutional Adoption

#XRP

- Technical indicators show XRP in consolidation with potential bullish breakout above $2.9663 resistance

- Institutional partnerships with Securitize, BlackRock, and VanEck driving positive sentiment

- Growing Wall Street engagement through JPMorgan's Ripple Swell participation signals mainstream adoption

XRP Price Prediction

XRP Technical Analysis

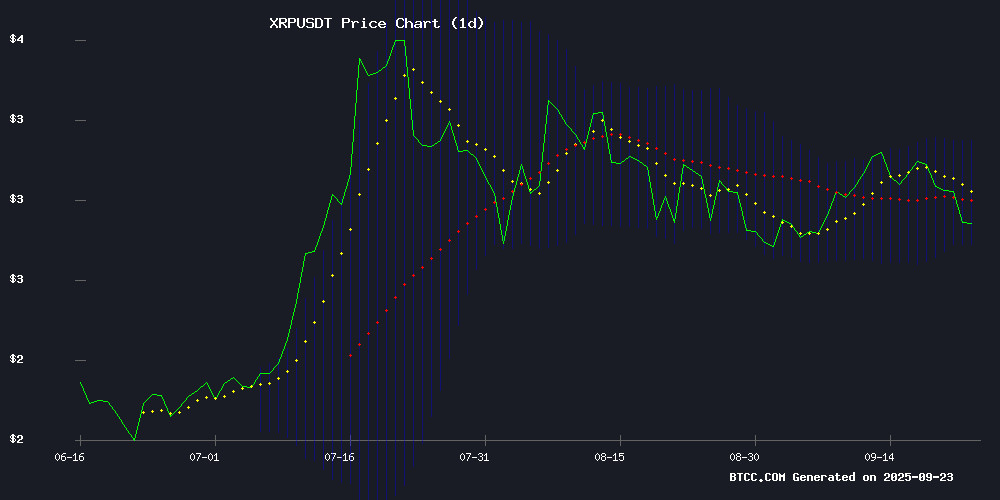

According to BTCC financial analyst William, XRP is currently trading at $2.8573, slightly below its 20-day moving average of $2.9663, indicating potential short-term resistance. The MACD shows a slight bullish crossover with the histogram at 0.0048, suggesting weakening downward momentum. XRP is trading within the Bollinger Bands with support at $2.7691 and resistance at $3.1635, indicating a consolidation phase. William notes that a break above the 20-day MA could signal renewed bullish momentum.

XRP Market Sentiment Analysis

BTCC financial analyst William observes that recent institutional developments are creating positive sentiment for XRP. The partnerships with Securitize to benefit BlackRock and VanEck token holders, along with JPMorgan's participation at Ripple Swell 2025, demonstrate growing Wall Street engagement. However, William cautions that emerging alternatives like Remittix and current market volatility require careful monitoring. The expanding ecosystem utility through SAVVY MINING's cloud contracts provides additional fundamental support.

Factors Influencing XRP's Price

Ripple Price Forecast: XRP Stabilizes Amid Institutional DeFi Push

XRP shows resilience above the $2.83 support level after Monday's sharp drop to $2.69 triggered liquidations. Three technical scenarios emerge: consolidation NEAR current levels, a rebound toward $3.00, or further decline to $2.50.

Ripple's updated roadmap reveals aggressive institutional DeFi ambitions, with XRP Ledger now ranking among top-ten chains for real-world asset tokenization. The platform has surpassed $1 billion in monthly stablecoin volume, with enhancements enabling stablecoin payments and collateral management.

Retail interest wanes as futures open interest plunges to $7.64 billion, while institutional adoption accelerates. Ripple plans a Q4 lending protocol launch, positioning XRPL as a bridge between traditional finance and blockchain innovation.

Ripple Partners with Securitize to Launch Smart Contract Benefiting BlackRock and VanEck Token Holders

Ripple CEO Brad Garlinghouse announced a strategic partnership with Securitize to introduce a smart contract enabling holders of BlackRock's BUILD and VanEck's VBILL to exchange shares for Ripple's stablecoin RLUSD. This integration provides a 24/7 stablecoin off-ramp, enhancing liquidity and interoperability for tokenized treasury products.

Jack McDonald, SVP of Stablecoins at Ripple, emphasized the institutional utility of RLUSD, citing regulatory clarity and stability as key advantages. The MOVE bridges traditional finance with crypto, unlocking new liquidity avenues and enterprise-grade use cases.

BUILD and VBILL, both tokenized short-term treasury funds, will now offer instant swaps to RLUSD while maintaining on-chain yield exposure. The collaboration with Securitize underscores Ripple's focus on scalable infrastructure for institutional adoption.

Ripple and Securitize Partner to Enable RLUSD Minting from BUIDL and VBILL Tokens

Ripple has forged a strategic partnership with Securitize, a leading platform for tokenized real-world assets, to introduce a novel smart contract mechanism. This innovation enables BUIDL and VBILL token holders to mint RLUSD, Ripple's native stablecoin, marking a significant step in bridging traditional finance with the crypto ecosystem.

The smart contract acts as an off-ramp for BlackRock's BUIDL and VanEck's VBILL tokens, which represent short-term treasury funds. Holders can now swap these tokens for RLUSD in a 24-hour market, enhancing liquidity and utility for assets previously limited to DeFi collateral or reserves.

With BUIDL held by just 55 wallets and VBILL on four ethereum addresses, the partnership unlocks new selling options for these conservatively growing assets. 'Making RLUSD available as an exchange option for tokenized funds is a natural next step,' said Jack McDonald, SVP of stablecoins at Ripple, emphasizing the stablecoin's institutional-grade regulatory clarity and stability.

XRP Faces Volatility as Investors Eye Emerging Alternatives Like Remittix

XRP's price trajectory dominates crypto discussions as analysts project potential declines below $2.50 by 2025. The token currently trades at $2.85, reflecting a 4.55% daily drop amid heightened volatility. Trading volume surged 134.97% to $7.92 billion, signaling intense market activity.

While Ripple's institutional relevance persists, capital increasingly flows toward utility-driven presales. Remittix has raised $26.3 million, demonstrating tangible adoption through its live Beta Wallet for cross-border transactions. This shift underscores growing investor preference for solutions over speculation.

The remittance token's traction contrasts with XRP's price uncertainty. Market participants now scrutinize low-cap assets with concrete use cases, potentially reshaping 2025's altcoin landscape.

JPMorgan to Present at Ripple Swell 2025 Amid Wall Street's Growing Crypto Engagement

Ripple's Swell conference has secured a significant coup with JPMorgan's Scott Lucas, Head of Markets Digital Assets, joining the speaker lineup. The event, scheduled for November 4–5 in New York, will convene leaders from traditional finance and crypto, including representatives from BlackRock, Citi, Fidelity, and State Street.

The agenda highlights institutional momentum behind digital assets, with panels on tokenization and global banking infrastructure. While Lucas' specific session remains undisclosed, the participation of these TradFi heavyweights signals deepening crossover between Wall Street and blockchain.

Market observers note the development follows JPMorgan's recent blockchain initiatives, including its Onyx division's work with tokenized collateral. XRP holders view the bank's presence as validation, though the agenda carefully avoids explicit endorsement of any particular cryptocurrency.

Ripple Price Analysis: XRP Holds Key Support Amid Market Correction

Ripple's XRP faces a pivotal moment as it tests crucial technical levels following a sharp pullback from recent highs. The digital asset retreated after failing to breach upper resistance, now hovering near the convergence of its 100-day moving average and horizontal support at $2.85.

Traders are watching for either a bullish reversal from this demand zone or a breakdown toward the $2.0-$2.1 safety net. The 4-hour chart reveals a descending channel pattern, with immediate resistance near $3.1 determining whether the correction deepens or buyers regain control.

XRP Price Prediction for October 2025: Analyst Targets $5 Breakout

XRP's price trajectory for October 2025 is drawing significant attention as the cryptocurrency fluctuates between $2.8 and $3.0. Market participants are speculating whether a breakout could propel the asset to $5, a target set by analyst CryptoBull. Technical patterns and improving regulatory conditions are fueling optimism.

CryptoBull's analysis highlights a symmetrical triangle formation on XRP's weekly chart, a pattern often preceding substantial price movements. The consolidation phase, ongoing since midyear, suggests an impending decisive move. "The setup aligns with historical breakout scenarios," the analyst noted, emphasizing the potential for a rally.

Regulatory clarity remains a critical catalyst. With the SEC lawsuit nearing resolution, institutional interest in XRP could surge, further supporting bullish projections. Traders are positioning for volatility, with key resistance levels at $3.50 and $4.20 acting as interim targets before the $5 mark.

SAVVY MINING Launches XRP Cloud Mining Contract, Expanding Ecosystem Utility

SAVVY MINING, a UK-based cloud mining platform, has introduced a dedicated XRP mining contract, enabling holders to earn passive income without converting their assets. The move signals growing institutional interest in diversifying blockchain infrastructure strategies while leveraging XRP's established cross-border payment capabilities.

XRP's integration with cloud mining marks a strategic evolution beyond its original use case in global payments. "Many holders seek flexible asset utilization," a SAVVY MINING spokesperson noted, highlighting the demand for accessible mining solutions requiring no technical expertise.

The contract's global availability through savvymining.com capitalizes on XRP's low-fee architecture, now repurposed as a yield-generating instrument. This development follows broader industry trends of repurposing layer-1 assets for infrastructure participation rewards.

XRP Price Prediction: Surging Open Interest Signals Potential Market Breakout

XRP futures markets are flashing bullish signals as open interest surges past $9 billion, marking a resurgence in trader confidence. The cryptocurrency's price recently tested $3.17 before consolidating near $3.12, supported by a 60% spike in trading volume.

Derivatives data reveals an 8.6% open interest increase within 24 hours, suggesting growing Leveraged positions. Technical analysts identify $3.40-$3.65 as the next resistance zone, though failure to maintain support at $3.00 could trigger profit-taking.

While XRP dominates attention, emerging projects like LAYER Brett are gaining traction with staking rewards and presale opportunities. These alternative investments appeal to traders seeking portfolio diversification amid crypto market volatility.

Is XRP a good investment?

Based on current technical and fundamental analysis, XRP presents a compelling investment opportunity with measured risk. The cryptocurrency is currently trading at $2.8573, showing consolidation below key resistance levels. Technical indicators suggest potential for upward movement, particularly if XRP can break above the 20-day moving average at $2.9663.

| Metric | Current Value | Significance |

|---|---|---|

| Current Price | $2.8573 | Trading below 20-day MA |

| 20-day Moving Average | $2.9663 | Key resistance level |

| MACD Histogram | +0.0048 | Bullish momentum building |

| Bollinger Band Support | $2.7691 | Critical support level |

| Bollinger Band Resistance | $3.1635 | Near-term target |

The institutional partnerships with major financial players and expanding utility through cloud mining contracts provide strong fundamental support. However, investors should be aware of market volatility and consider dollar-cost averaging strategies.